Supply Chains

Aidenvironment’s programs are differentiated by its focus on driving results. By increasing information access, we enable a wide range of actors to use their influence and resources to halt deforestation.

We support governments, companies, civil society organizations and the financial sector with actionable data and analysis to eliminate commodity-driven deforestation. To identify opportunities to prevent deforestation, AidEnvironment monitors and analyses data on land use, land ownership, supply chains, corporate ownership structures and finance flows, which is supplemented by satellite imagery and on-the-ground investigations.

We work on beef, leather, soy, palm oil, cocoa, coffee, timber, and pulp and paper supply chains in tropical forest countries, particularly in Latin America and Southeast Asia. With evidence-based insights, stakeholders are equipped with accurate, reliable, and timely information to engage with companies operating in different sectors and supply chain stages, or to develop targeted campaigns and strategic litigation focused on commodity producers, traders and buyers that fail to strengthen their sustainability policies and practices.

Preventing deforestation is a crucial element of climate action that can lead to the achievement of the sustainable development goals, the targets of the Paris agreement, and deliver the European Green Deal. Learn more about our Theory of Change here.

Real-time Deforestation Monitoring

We conduct near real-time monitoring of deforestation, forest degradation , and fire events in global commodity supply chains, combining this with social, environmental, and political risk analysis.

Supply Chain Mapping & Trade Data Analysis

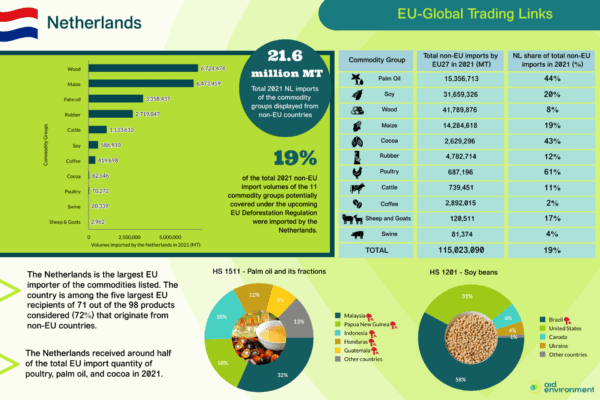

We map global supply chains and trade flows of palm oil, soy, beef, leather, coffee, and timber products from farm or ranch to downstream sectors, to promote transparency, awareness, and traceability in forest-risk commodities sectors.

Policy Analysis &

Bench-marking

We develop benchmark and research studies on zero-deforestation and responsible sourcing policies, implementation, and disclosure.

Translating Sustainability Risks into Financial Risks

We support integrating no-deforestation and sustainability objectives in investor decision-making, by translating sustainability risks into financial risks.

Introduction The take-up of No Deforestation, No Peat, No Exploitation (NDPE) policies by the palm oil industry has had a significant impact on reducing forest loss for oil palm plantation development. A 2020 study by Aidenvironment and our partners determined that 83% of refining capacity in Indonesia and Malaysia, accounting for approximately 50% of the world’s refining capacity, is covered […]

Read more

Article by Sarah Drost AidEnvironment continuously supports civil society, law charities, campaigners, and journalists with supply chain mapping and global trade data analyses. This year we have mapped the Colombian palm oil supply chain, assessed how the Unites States is tied to scope-3 emissions linked to global commodity trade and consumption. We have also mapped importing operators eligible under the […]

Read more

Article by Indonesia team In the first half of 2023, the industrial forest plantation sector in Indonesia was responsible for significant deforestation, with ten companies collectively contributing to the clearance of 10,000 hectares of forest. Approximately 81% of this deforestation was attributed to just three companies. Furthermore, six out of the top ten companies for forest clearance were also among […]

Read more